Litigation Funding — High Incentives, Low Visibility

NYPD officers threw Joseph Gill against a cop car, mistaking him for a robber; LawBuck$, a litigation funder, saw a financial opportunity. The funder advanced $4,000 to Gill for legal costs but by the time the case was settled the interest had accrued to 29 times the original amount, a total of $116,000.

The small but rich industry of litigation funding, also sometimes called litigation finance or lawsuit lending, increasingly resides behind the country’s most lucrative legal cases— turning the judicial system into the latest investment opportunity for various players from loan lenders to private equity.

Financiers make calculated decisions in advancing funds to cover legal costs or other expenses for plaintiffs in return for a big payout if the plaintiff wins their case. The funder recoups the original advance with interest as long as the plaintiff wins.

The industry’s largest 47 funders manage $12.4 billion in assets according to an industry report. Only two funders are publicly traded companies so much of the industry’s financing is hidden from the public and the full size of the industry is difficult to determine.

In most courts, plaintiffs are not required to disclose where the funding for a case originates and the financing agreements typically include iron-clad non-disclosure clauses, which limit what parties involved can reveal. Only on rare occasions, does a judge require disclosure or relationships between parties revealed in discovery of a case. The industry’s lack of transparency or oversight allows for bad actors to take advantage and be shielded from public scrutiny.

A Growing Industry

“Originally this industry was for litigators by litigators,” said Rebecca Berrebi, a litigation finance consultant speaking on a panel for Wake Forest University. “You have to be able to understand the merit of a case in order to decide whether or not it's a winner or a loser, but what has happened is the financial markets have taken a hold of this because it's really about money and it is just another type of asset that can be capitalized and monetized.”

The industry has boomed since 2000 with nearly all of the largest commercial funders having been founded since. According to Vannin Capital’s research, litigation funding grew at an annual rate of around 40 percent between 2012 and 2016.

“I was in the industry in its infancy and the industry was for the first 10 years or so pretty fringe, but now you've got publicly traded companies and many institutional investors invested in litigation funders,” said Charles Agee, CEO of Westfleet Advisors , an advising company in the industry. “Many large asset managers have litigation funding areas and of course big law and leading litigation boutiques are very familiar with litigation finance, using it routinely.”

The number of new investment commitments devoted to litigation with AmLaw 200 firms increased by 46 percent from 2020 to 2021 according to Westfleet’s most recent report. Similarly, the industry’s largest funder, Burford Capital, emphasized in their promotional materials that 94 AmLaw 100 and 90 Global 100 firms have sought their capital.

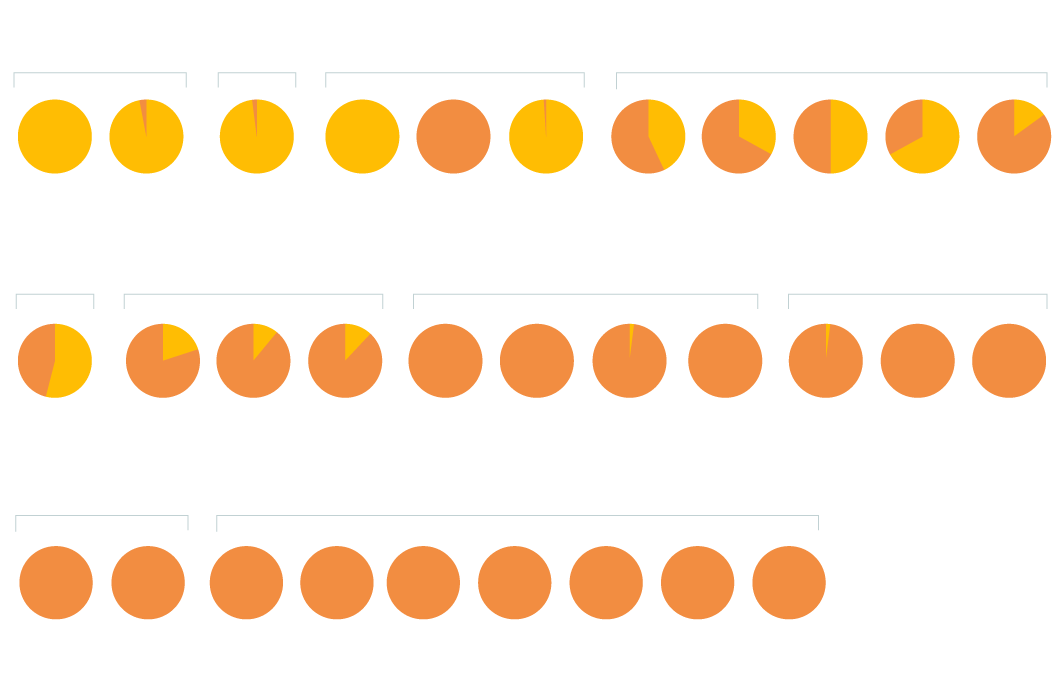

Billions were invested in litigation finance since 2019 including to top law firms

An industry report on 47 of the largest commercial litigation funders indicated industry growth year over year

12.4

Total AUM Dedicated to U.S. Investments

11.3

9.4

2.8

New Funding Commitments per Year

2.3

1.2

New Funding to AmLaw 200 Firms

0.7

0

2019

2020

2021

12.4

Total AUM Dedicated

to U.S. Investments

11.3

9.4

2.8

New Funding

Commitments per Year

2.3

1.2

New Funding to

AmLaw 200 Firms

0.7

0

2019

2020

2021

12.4

Total AUM Dedicated

to U.S. Investments

11.3

9.4

2.8

New Funding

Commitments per Year

2.3

1.2

New Funding to

AmLaw 200 Firms

0.7

0

2019

2020

2021

Source: Westfleet Advisors Industry Report

Funders in the industry self-sort themselves primarily into the two categories of commercial or consumer litigation financing, echoing the divide between commercial law and consumer law in the U.S. legal system. Commercial litigation funding generally invests funds where both the plaintiffs and defendants are business entities in legal areas such as patent infringement, international arbitration, or business contracts. Consumer litigation funding often provides advances for plaintiffs seeking settlements for personal injury cases; funders provide cash to cover medical expenses or to keep the lights on before the case is settled or won by the plaintiff in return for a significant portion of the award when the case closes.

Particularly, those funders operating in the commercial space prefer not to be associated with the consumer side, fearing regulation aimed to protect consumers also affecting the financial profitability of the industry’s commercial side.

Critics of the industry such as the U.S. Chamber of Commerce's Institute for Legal Reform “raise talking points with regards to the evils of commercial litigation finance, by pointing to the pratfalls that have arisen in consumer litigation financing,” said Eric Blinderman, an executive at the commercial litigation funder, Therium Capital Management. “It's not like comparing apples to oranges because at least those are fruit— it's like comparing apples to a desk.”

However, both segments of the industry profit from the U.S. legal system and benefit from the lack of regulation of the industry, at large. Whether it’s a business or consumer plaintiff, funders rely on receiving a portion of the plaintiffs’ winning sum.

It’s not a loan.

Theresa Guss, a plaintiff, was advanced $21,300 upfront by two funders, MFL Case Funding and Law Buck$ to pursue her slip-and-fall case against New York City in 2005. She was awarded $2.1 million in a settlement for her injuries including her broken hip, however she died as a result of complications from her surgery. When the case was decided over a decade later, the litigation funders demanded the entirety of the $2.1 million be split between the two funders to pay off the high interest incurred; Guss’s family was left with nothing of the award.

High interest rates such as these are typically limited by what each state considers reasonable called general usury limits. For example, New York has a 16 percent limit for civil usury and 25 percent limit for criminal usury. Litigation finance is generally exempt from these regulations because of the risky nature of funding legal cases.

If a plaintiff loses the case a funder has invested in, there is no recourse for the funder to recoup the funds spent on expensive litigation or consumers’ expenses. As a result, funders are extremely careful in selecting the cases to pursue and can charge interest rates that can be compounded to double or triple the normal limits. A plaintiff can find when they receive their awards from winning their case or a settlement that a significant proportion of their winning sum has to be turned over to the litigation funder and in extreme cases, the entirety.

One of the complaints by Guss’s lawyer, Frank Delle Donne, was the lack of clear communication in the funding agreement of the annual rate, which is a common problem in these agreements.

While online applications for an advance are simple and in plain language, legislation funding agreements are often not. Over the past decade, there are countless plaintiffs, who, lured by quick upfront payments, signed agreements without a full understanding of the interest rates involved and the full repercussions.

Consumer litigation funders highlight "Risk Free!" process to get cash quickly

Website of Lawfund Capital Group, LLC (lawfund.com)

Source: Lawfund Capital Group, LLC (lawfund.com)

This was the case for a number of first responders to the September 11th World Trade Center attacks and former National Football League (NFL) players suffering from brain injuries, who sought upfront payments from a litigation funder, RD Legal Funding, LLC, while awaiting their awards from victim compensation funds; the victims were allegedly forced to pay interest rates between 18 percent to over 250 percent, well over New York’s civil usury and criminal usury limits.

New York’s Attorney General and the Consumer Financial Protection Bureau filed a lawsuit against the company in part because allegedly the victims’ contracts misrepresented what was being offered through convoluted contracts.

“The alleged actions by RD Legal—scamming 9/11 heroes and former NFL players struggling with severe injuries—are simply shameful,” said Attorney General Schneiderman in the press release. “RD Legal used deceptive tactics to charge unlawfully high interest rates for advances on settlement and compensation funds, allowing them to profit off the backs of these unsuspecting individuals.”

While many in commercial litigation funding argue that predatory interest rates only happen on the consumer side of the industry, commercial funders like Fortress Investment Group charge patent inventors and owners high interest rates as well on funding for patent litigation.

“It's like a trap,” said a former employee of a large commercial litigation funder. “I've seen people get honestly ripped off because even if they make money after the litigation goes through and they're successful, all they make they have to pay back for the loan that they got.”

Bad Actors

The hidden nature of litigation funding has proved very lucrative and advantageous for bad actors.

In August of 2021, the U.S. Attorney General for the Southern district of New York charged a group of lawyers and doctors with defrauding business and insurance companies; the group allegedly recruited vulnerable individuals to stage trip-and-fall incidents and file fraudulent lawsuits paid for by litigation funding. The funding paid for medical expenses and advances for plaintiffs but then reaped the rewards, when the plaintiffs were awarded their settlements.

According to the Justice Department’s press release, “the interest rates were so high that oftentimes the majority (if not all) of the proceeds that were awarded in the Fraudulent Lawsuits were paid to the Funding Companies.”

Particularly in commercial litigation finance, law firms and funders risk millions on a case and because there is no recourse to recoup costs if a case is lost, those involved can get desperate when one of the parties involved wants to back out.

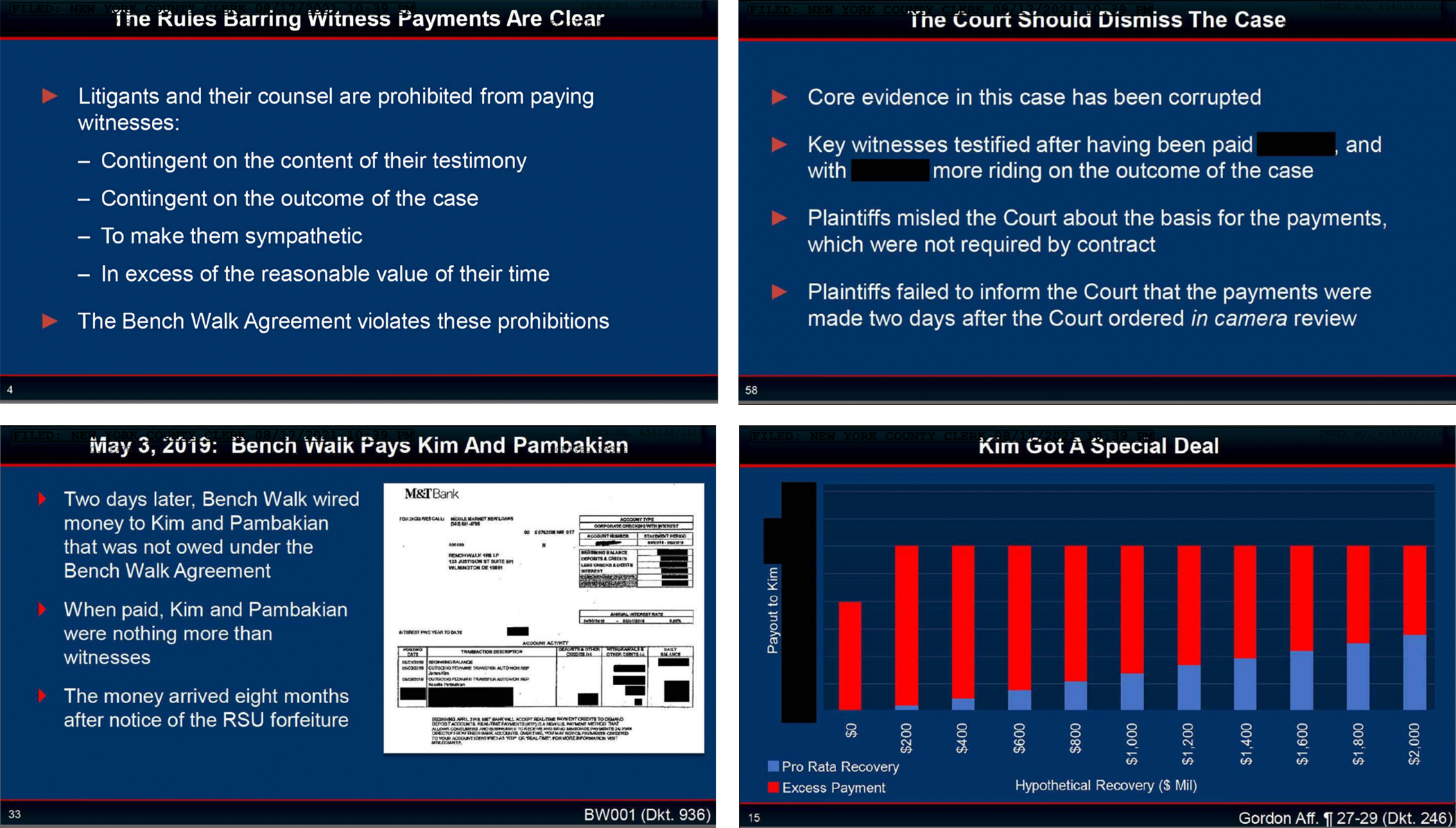

In December, parties from the large law firm, Gibson-Dunn, and the litigation funder, Bench Walk Advisors, were accused of having paid witnesses a million dollars in a case, where Sean Rad, Tinder’s founder, sued Match Group, the parent company of Tinder and Match.com for $2 billion. Only in legal discovery were the payments and the role of litigation funding revealed when communications between two witnesses, lawyers from Gibson-Dunn, executives at Bench Walk, and Rad came to light.

Court records make strong case that litigation funder paid off witnesses

Presentation to the Court on Motion to Dismiss Case — Sean Rad et al v. IAC/InterActiveCorp et al

Source: New York County Supreme Court Records

“The agreement at issue [payments to witnesses] is subversive of the orderly and efficient administration of justice, creates an incentive for biased testimony, and threatens the integrity of the judicial system by giving the appearance that the truth is a commodity,” said Hal Lieberman, the former Chair of the Committee on Professional Discipline if the New York City Bar Association, in his expert testimony according to court records.

Foreign Investment in the U.S. Legal System

The high return on investment and sheer size of the U.S. legal industry is also highly lucrative for foreign investors in conjunction with the largest commercial funders. Like most private equity investing companies, litigation funders are not required to publicly reveal where or whom their funding comes from. Only if the company is investing more than $100 million does limited information have to be filed with the U.S. Securities and Exchange Commission (SEC). SEC records from ten of the industry’s largest private companies provide a small glimpse of the industry.

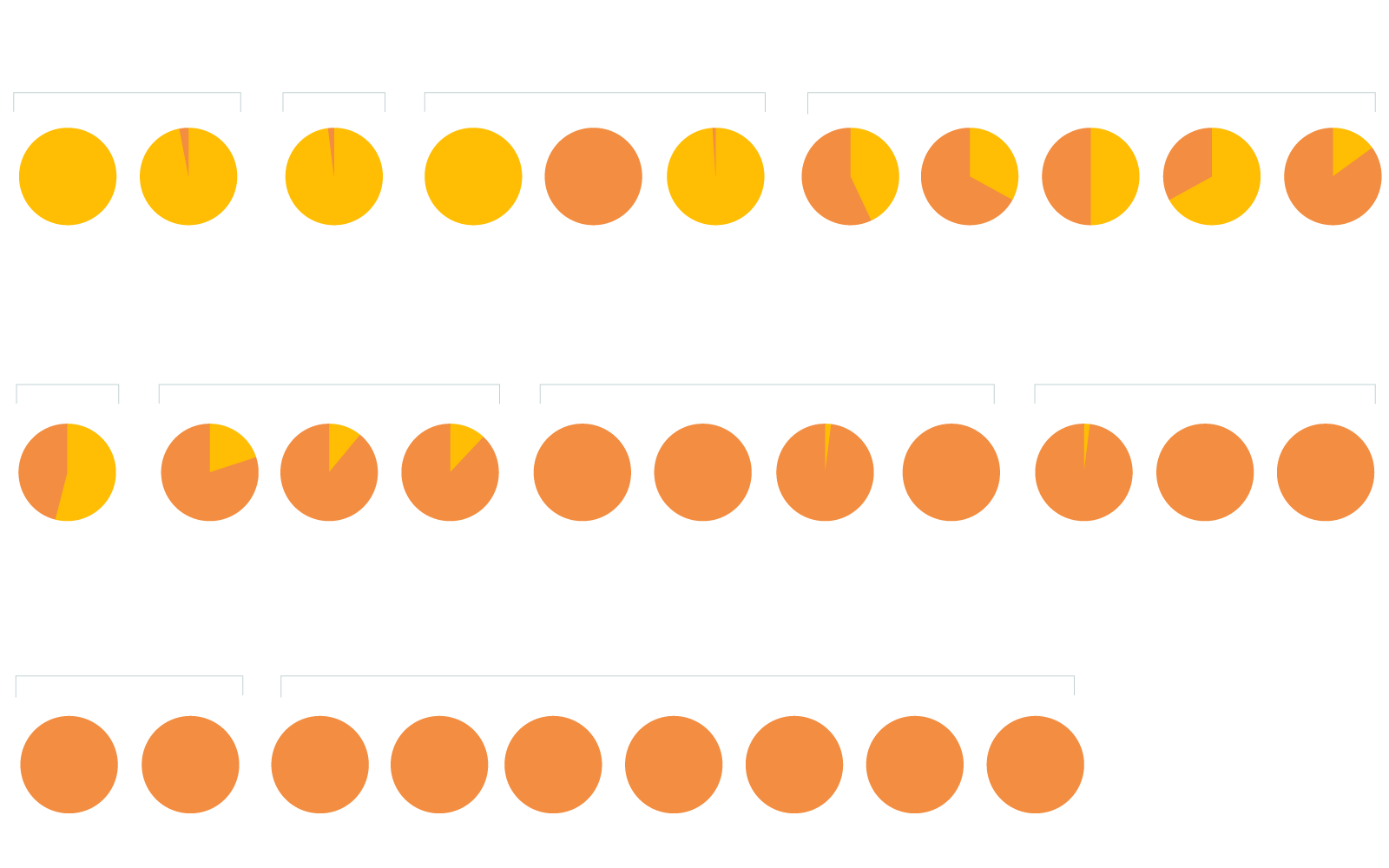

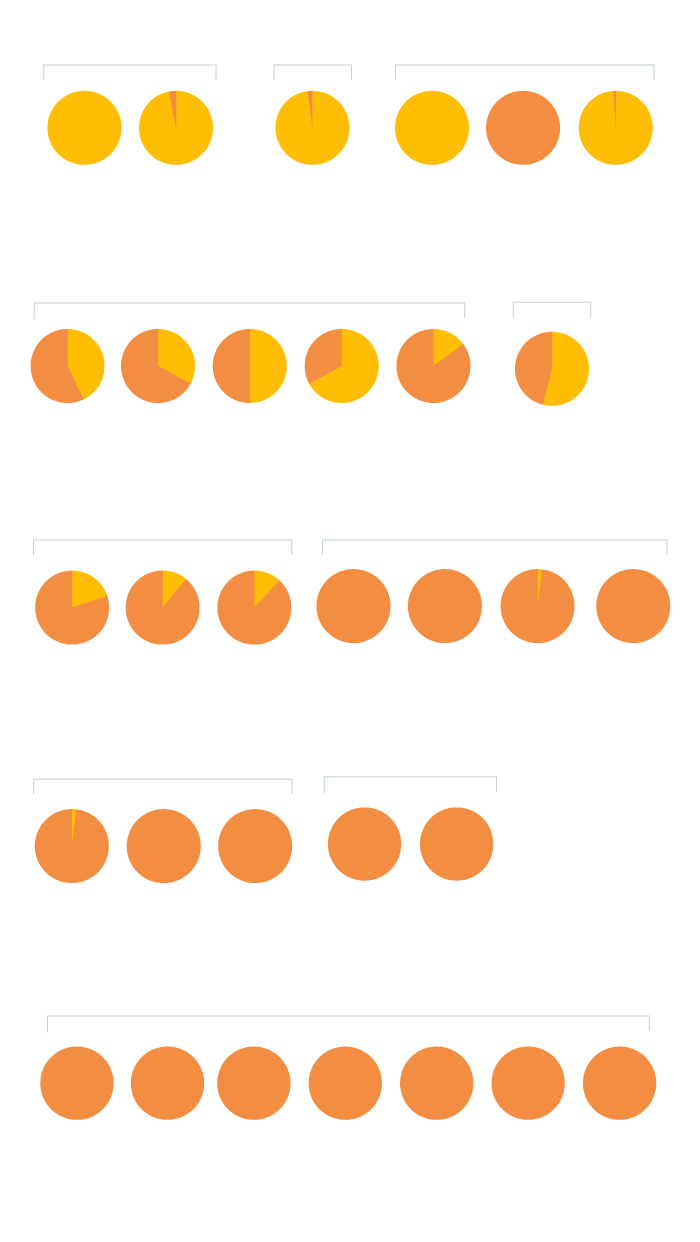

Investments in U.S. litigation include millions from foreign investors

SEC records show the percentage of foreign investment in private equity funds for 10 of the industry's largest investors.

BRICKELL KEY

ASSET MANAGEMENT LLC

CURIAM

CAPITAL LLC

DELTA CAPITAL

PARTNERS MANAGEMENT LLC

TRGP

INVESTMENT PARTNERS, LP

$176.3MM

$7.6MM

$184.3MM

$1.4MM

$34.9MM

$113.1MM

$4.0MM

$17.4MM

$0.4MM

$0.01MM

$111.6MM

LONGFORD

CAPITAL MANAGEMENT, LP

GLS

CAPITAL, LLC

PARABELLUM

CAPITAL LLC

STATERA

CAPITAL, LLC

$178.2MM

$166.1MM

$465.9MM

$56.6MM

$28.5MM

$461.8MM

$430.6MM

$119.5MM

$1.5MM

$0.9MM

$5.7MM

LAKE WHILLANS

CAPITAL PARTNERS LLC

THERIUM

CAPITAL MANAGEMENT (USA), INC.

$105.8MM

$0.7MM

$6.3MM

$15.3MM

$0MM

$26.1MM

$12.7MM

$5.9MM

$5.7MM

BRICKELL KEY

ASSET MANAGEMENT LLC

CURIAM

CAPITAL LLC

DELTA CAPITAL

PARTNERS MANAGEMENT LLC

TRGP

INVESTMENT PARTNERS, LP

$176.3MM

$7.6MM

$184.3MM

$1.4MM

$34.9MM

$113.1MM

$4.0MM

$17.4MM

$0.4MM

$0.01MM

$111.6MM

GLS

CAPITAL, LLC

PARABELLUM

CAPITAL LLC

LONGFORD

CAPITAL MANAGEMENT, LP

STATERA

CAPITAL, LLC

$178.2MM

$166.1MM

$465.9MM

$56.6MM

$28.5MM

$461.8MM

$430.6MM

$119.5MM

$1.5MM

$0.9MM

$5.7MM

LAKE WHILLANS

CAPITAL PARTNERS LLC

THERIUM

CAPITAL MANAGEMENT (USA), INC.

$105.8MM

$0.7MM

$6.3MM

$15.3MM

$0MM

$26.1MM

$12.7MM

$5.9MM

$5.7MM

BRICKELL KEY

ASSET MANAGEMENT LLC

CURIAM

CAPITAL LLC

DELTA CAPITAL

PARTNERS MANAGEMENT LLC

$176.3MM

$7.6MM

$184.3MM

$1.4MM

$34.9MM

$113.1MM

GLS

CAPITAL, LLC

TRGP

INVESTMENT PARTNERS, LP

$178.2MM

$4.0MM

$17.4MM

$0.4MM

$0.01MM

$111.6MM

PARABELLUM

CAPITAL LLC

LONGFORD

CAPITAL MANAGEMENT, LP

$166.1MM

$465.9MM

$56.6MM

$28.5MM

$461.8MM

$430.6MM

$119.5MM

LAKE WHILLANS

CAPITAL PARTNERS LLC

STATERA

CAPITAL, LLC

$1.5MM

$0.9MM

$5.7MM

$105.8MM

$0.7MM

THERIUM

CAPITAL MANAGEMENT (USA), INC.

$6.3MM

$15.3MM

$0MM

$26.1MM

$12.7MM

$5.9MM

$5.7MM

Source: U.S. Securities and Exchange Commission — Investment Adviser Public Disclosure Forms

Some of these funders rely on considerable foreign investment when raising pools of capital to invest in cases (or portfolios of cases). Two private investment funds of Brickell Key Asset Management— Brickell Key Investments LP and Juridica Investments Limited are reported as both having nearly all foreign investment and the latter is registered in the tax haven, Guernsey.

Delta Capital Partners splits one of their funds into two pools, one registered in the Cayman Islands with 100 percent foreign investment and another with only U.S. investors. Their third private fund requires a minimum investment of $100 million and is nearly all (99%) foreign investors.

One of the only public funders, Burford Capital reported in their 2021 annual report that 28 percent of the entirety of their 2021 $2.8 billion AUM, or total capital invested in funds, was attributed to a single investor, a sovereign wealth fund that wanted their identity kept private.

Political Incentives

Beyond financial incentives, the murky nature of litigation funding allows for actors to fund legal cases with political incentives as well as financial. Famously, Hulk Hogan’s case against Gawker caused the news outlet to go bankrupt with an assist of third-party litigation funding from Peter Thiel, the PayPal co-founder and right-wing donor.

More recently, U.S. Rep. Devin Nunes sued Hearst Media for defamation regarding an article in Esquire Magazine about his family’s Iowa dairy farm. The judge on the case suspected litigation funding was involved because Nunes’s brother and the plaintiff, Anthony Nunes III, had “no idea” who paid the lawyers representing the plaintiffs.

“Anthony Nunes III’s lack of knowledge about who is paying the attorneys prosecuting this action raises legitimate concern about not only who may be in charge of the lawsuit, but also whether Plaintiffs are the still the real parties in interest,” wrote Judge Mark Roberts of U.S. District Court for the Northern District of Iowa.

The lack of required disclosure also allows deep-pocketed investors to spend on cases while concealing their involvement.

In 2017, Des Moines Water Works sued three Iowa districts regarding polluted water supplies in hopes of setting a precedent for environmental rights legislation. The organization discovered with an open records request that the Agricultural Legal Defense Fund, which was paying the defense’s legal costs, was financed by larger agrochemical corporations including Koch, DuPont, and Monsanto. Being outspent by the defense fund, the Des Moines Water Works dropped its case.

As a result, “not a lot has happened in terms of changes that will result in long term water quality improvements since the case was dismissed,” said Ted Corrigan, the current CEO and General Manager of Des Moines Water Works.

Legislating Litigation Funding

Over the past several years, a number of bills with various restrictions on litigation funding were introduced into state legislatures and U.S. Congress with limited success.

“It's a new concept [litigation funding],” said State Senator Adrian Dickey of Iowa. “Even my fellow legislators haven’t heard about it, much less have any idea how much of a problem it’s becoming.”

Dickey owns a trucking company and first became aware of the litigation funding industry from trucking industry publications' coverage of rising insurance costs and “nuclear verdicts” attributed to litigation funding.

Supporters of litigation funding criticize the motives behind these bills and their tactics; some say bills limiting interest rates kneecap the industry rather than provide actual safeguards for people.

“There's a rash of bills literally to ban the industry,” said Eric Schuller, President from the Alliance for Responsible Legal Funding, an association of consumer litigation funders. “The insurance industry has realized that this is an industry that is not going to go away, but they want to restrict it and they want to put in parameters; so, they've been able to pass legislation in a couple of states— West Virginia and Arkansas that have very strict rate restrictions on consumer legal funding, where we can’t operate.”

Schuller advocates and works with legislators on the text of legislation relating to litigation funding including the most recent bill in Missouri. He believes bills should require funders to clearly define terms in agreements with consumers and not pay referral fees to companies (or law firms) for new consumers. He also advocates for no rate caps but requiring contracts to be clearly disclosed, allowing consumers to compare rates across companies more easily, a solution he said lowered rates in Oklahoma.

He said, “I'd love to have 50 bills in 50 States because it puts clearly defined measures that protect consumers, protect the businesses, and allows the product to be offered clearly.”

While he supports clear disclosure to the consumer, he along with other litigation funding supporters actively fight laws requiring disclosure of finances of plaintiffs (including litigation funding) to the defense side of litigation, a tactic they argue, only serves the defense.

“I think the motive certainly behind this is to give a leg up on litigation to one side, specifically the insurance companies and defendants in this situation,” said Sam Marcellino of the Ohio Association for Justice in testimony against Ohio’s bill on litigation funding disclosure.

In contrast, Page Faulk, Senior Vice President of Legal Reform Initiatives at the U.S. Chamber Institute for Legal Reform argued, “the defendant has a right to know who is really prosecuting the lawsuit it faces.”

Echoing these sentiments, Joshua Landau, Patent Counsel at the Computer & Communications Industry Association (CCIA), said, “every patent plaintiff wants to present themselves as the small inventor who somebody else unjustly took their invention; that story becomes a lot more difficult to tell if the jury is aware that actually, you [the plaintiff] didn't invent it, and you're being financed by a large litigation finance company that stands to take most of the benefit of this.”

The chamber along with others have petitioned the Advisory Committee of Civil Rules to amend rule 26 Federal Rules of Civil Procedure, which would require disclosure of the agreements in cases and Faulk hopes, “that Congress too will do something if the advisory committee does not move forward with the legislation.”

U.S. Congressman Darrell Issa of California 50th congressional district and U.S. Senator Chuck Grassley of Iowa have repeatedly introduced the Litigation Funding Transparency Act into Congress. Grassley’s office even used the same quotes on the press releases from 2019 and 2021— “for too long, obscure third-party litigation funding arrangements have secretly funneled money into our civil justice system, without any meaningful oversight, all for the purpose of profiting off someone else’s case.”

“It's making a lottery of our legal system and there's absolutely no place for that,” said similarly by State Senator Dickey. “There's endless opportunities to invest— I don't think our legal system should be one of them.”